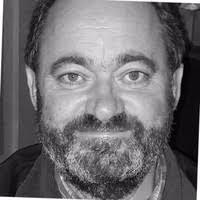

Stuart Lawrence, the author of Silence is Not an Option, and brother of murdered schoolboy, Stephen Lawrence, is participating in a diversity and inclusion workshop led by Products of Change co-founder, Helena Mansell-Stopher at the Brand & Licensing Innovation Summit taking place this month.

The workshop is one of the final sessions to be announced for the packed three-day online event, which takes place June 9th to 11th. Designed specifically to help middle-management, business leaders and owners navigate the changing retail, content and consumer landscape, three-day passes to B&LIS cost £249 (£224 for Licensing International members and qualified retailers are invited to attend free of charge.)

Emoji company CEO and founder Marco Hüsges joins WildBrain CPLG’s EVP and managing director Maarten Weck and WildBrain Spark’s commercial director Rachel Taylor to reveal how they have built an extensive merchandise offering and robust retail presence for the Emoji brand in Europe, including a recently forged content and licensing partnership for new digital-first series Emojitown.

In their session, Emojitown: The Power of Building Brands with Digital-First Strategies, they will explore the significant potential of AVOD and digital strategies in driving successful licensing and merchandising campaigns to build brand success for the long-term.

Senior leaders, broadcast and brand licensing experts from Studiocanal (Valérie Rolandez-Barrios), WarnerMedia (Rachel Wakley) and Moonbug (Adam Steel) are also confirmed for a closing-day panel ‘New Streams of Consumerism: How Entertainment is Evolving’, which will look at how brands can create equivalent awareness and maintain visibility on streaming platforms with much shorter marketing windows than traditional entertainment releases.

Kornit Digital and EPIK will present sponsored workshops on DTR (direct to retail) and NFT (Non Fungible Tokens), respectively. Taking place on opening day, ‘How the licensing industry is evolving with direct to retail’ will look at one of the toughest challenges ever to face the traditional licensing model; and on the final day, ‘The NFT playbook’ is a deep dive into everything NFT and digital merchandise.

Each of three days of B&LIS focuses on a different theme, with exclusive keynotes as outlined below:

Day 1 – Trends and retail. Keynote: Innovate, adapt, disrupt: In conversation with Lars-Johan Jarnheimer, IKEA Group chairman

Day 2: CSR and sustainability: Keynote: Why the future will be blue – how to become an agent of change: Smurfs’ Philippe Glorieux and Caroline Petit of the United Nations Regional Information Center.

Day 3: Content & digital transformations: Keynote: The Wayfair boost: leveraging ecomm ads for product programmes, Ankit Mangal, director of Wayfair

“Covering everything from sustainability, to diversity and inclusion, sport, streaming, toys, gaming, NFTs, DTR, bricks n mortar and ecommerce, and the changing consumer trends among younger generations, B&LIS will draw out trends and insight from within and outside the brand and licensing industries to really help delegates drive the future direction of their brands, businesses and stores,” explained Anna Knight, VP Licensing, Informa Markets.

“This agenda will challenge you to take stock, open your mind and think differently, so be prepared for an inspirational three days.”

Delegates from the following companies have already signed up to attend: Aldi, Aykroyd & Sons, Amazon, Asda, Blue’s Clothing, Character World, Chupa Chups, DC Thomson Media, Dreamtex, EMP Merchandising, General Mills, Hachette, HTI Toys, Jaz Toys, Popgear, Primark, Simba Dickie, Tesco, Walt Disney Company, Beanstalk, The Entertainer, Unilever, ViacomCBS and Schwager & Steinlein Verlag.

The longlist of confirmed speakers include:

Rikesh Desai, Licensing Director – Merchandise, Partnerships and Interactive, UK & EMEA Consumer Products, BBC Studios

John Friend, Head of Halo and Xbox Consumer Products, Microsoft

Stephanie Freeman, Senior Global Licensing Manager – Outbound Licensing, The LEGO Group

Gabrielle Sims, Head of Licensing, FatFace

Dan Avener, Chief Executive Officer, MDR Brand Management

Karen Hewitt, Co-Founder, Character.com

Susan Bolsover, Global Licensing and Consumer Products Director – Penguin Ventures, Penguin Random House UK

June Kirkwood, Sustainable Licensing Consultant, Nutmeg Licensing & Sustaineers Consultants

Simon Gresswell, Managing Director, SGLP

Gary Pope, Co-Founder, Kids Industries

Graham Saltmarsh, Managing Director, Licensing International – UK

Ben Roberts, Content Editor, License Global

Claire McClelland, Client Executive – Entertainment, Kantar

Dorian Bloch, Senior Client Director, Market Intelligence, GfK

Helena Mansell-Stopher, Founder, Products of Change

Ian Shepherd, Founder and CEO, The Social Store

Emily Aldridge, Head of Global Licensing, Abysse Corp

Charlotte Delobelle, European Brand Ambassador, Fashion Snoops

Kate French, Senior Category Manager – Softlines (Footwear, Accessories, Home & Gifting), Hasbro

Steven Plackett, Managing Director, Vista Stationery & Print (Carousel Calendars)

Dan Grant, Licensing Director, Danilo

Leonora Aixas, Co-Founder, DNA Brands

Steve Cox, UK Sales Director, Keel Toys

Sue Stanley, Licensing Director, Brans In Limited

Mark Bezodis, Licensing Managing Director, Perry Ellis International

Scott Macrae, Brands, License, New Business and Partnerships Mission Lead, George at Asda

Dan Amos, Head of Gaming and Esports, Difuzed

Marie-Laure Marchand, SVP Global Consumer Products and Business Development, Chefclub

Valérie Rolandez-Barrios, Vice President of IP Licensing & Partnerships, Studiocanal

Jade Snart, Sustainability and Technical Compliance Expert, George at Asda

Alex Balzaretti, Senior Manager, Commonwealth Games Federation Partnership (CGFP)

Kate Gibson, Managing Director, Gibsons Games

Gary Jacobson, Brand Licensing Manager, Tottenham Hotspur

Lisa Hey, Head of Product Development, Character World

Claire Bradbury, Global Account Director, PowerStation Studio

Philippe Glorieux, Head of Marketing, Communications & Family Entertainment, IMPS – The Smurfs

Caroline Petit, Deputy Director, United Nations Regional Information Center (UNRIC)

Maxine Lister, Head of Licensing, Natural History Museum

Rachel Wakley, General Manager UK, WarnerMedia

Paul Hepworth, Vice President, Licensing, Liverpool Football Club

Sabine Hulsman, CEO, The Cookie Company Group

Pamela Stathaki, Global Head of Sustainability, The Marketing Store, Europe

Jeremy Goldsmith, Managing Director, Event Merchandising Ltd

Lars-Johan Jarnheimer, Chairman, Ingka Holding, IKEA Group

Adam Steel, Licensing & Franchise, Moonbug

Gary Ma, COO, Epik

Winston King, VP Partnerships, Epik

Daniel Ruben, Workflow Solutions Director, Kornit Digital

Alistair Mylchreest, Segment Head – Licensors, Kornit Digital

Frédérique Tutt, Global Toys Industry Advisor, NPD

Stuart Lawrence, Author, Silence Is Not an Option: You Can Impact the World for Change

Maarten Weck, EVP & Managing Director, WildBrain CPLG

Rachel Taylor, Commercial Director, WildBrain Spark

Marco Hüsges, CEO & Founder, emoji Company

Ankit Mangal, Director, Wayfair

Gary Grant, Founder and Executive Chairman, The Entertainer

John Baulch, Publisher and Managing Director, Toy World Magazine

Anita Majhu, Senior Licensing & Global Sustainability Manager, BBC Studios

Gianni Romano, Company Director, Lyfcycle